Transient Leisure Segment Drives Underlying Booking Growth

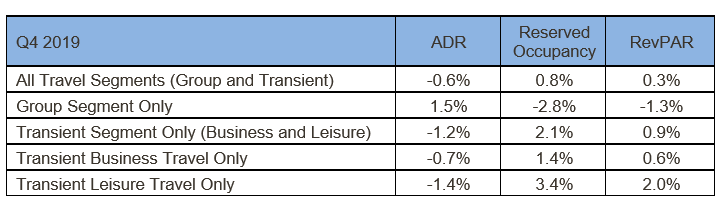

NEW YORK – November 26, 2019 – TravelClick, an Amadeus company, today released new data from the company’s November North American Hospitality Review (NAHR). According to the data, committed occupancy for the fourth quarter of 2019 through the third quarter of 2020 is up 2.1% compared to a year ago. The average daily rate (ADR) is down -0.6% based on reservations currently on the books for 2019. Group ADR is up 1.5%, while transient segment ADR is down -1.2% compared to the previous year. Transient business and transient leisure ADR are down -0.7% and -1.4% respectively.

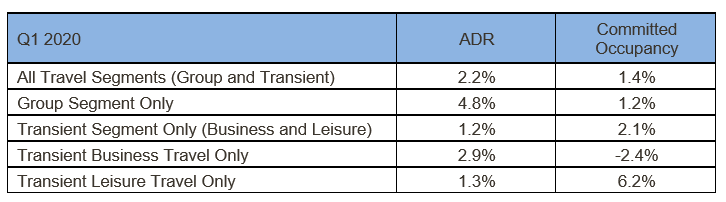

Additionally, 20 of the top 25 North American markets are showing an increase in bookings compared to one month ago. Group sales slow through the end of 2019 but resume in the first and second quarters of 2020, increasing 1.2% and 4.9% respectively.

“The latest booking trends continue to demonstrate underlying strength in both short term and upcoming year occupancy,” explains John Hach, Senior Industry Analyst, TravelClick. “The booking pace instability experienced through most of 2018 is becoming a distant memory. That concern is being replaced with numerous indicators displaying occupancy growth improvement continuing well into the third quarter of 2020.”

Twelve-Month Outlook (Q4 2019 – Q3 2020)

For the next 12 months (November 2019 – October 2020), transient bookings are up 3.3% year-over-year, and ADR for this segment is up at 1.7% compared to the previous year. When broken down further, the transient leisure (discount, qualified and wholesale) segment is up 3.6% in bookings, with ADR decreasing -0.7%. Additionally, the transient business (negotiated and retail) segment is up 0.8% in bookings and up 1.5% in ADR. Lastly, group bookings are up 3.9% in committed room nights* over the same time last year, and ADR is up 5.1%.

“The recent increases within the transient leisure segment creates both opportunities and challenges for hoteliers,” adds Hach. “While the volume of transient business is certainly growing, concurrently there is an abundance of new hotel openings and alternative lodging options available to consumers. Opportunistic hoteliers who take advantage of forward-looking business intelligence, including alternative accommodations data and online marketing solutions have the upper hand in capturing this rising tide.”

The November NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by November 1, 2019 for the period of November 2019 – October 2020.

*Committed Occupancy – (Transient rooms reserved + group rooms committed) / capacity

The third quarter combines historical data (October) and forward-looking data (November – December).

###

About TravelClick, an Amadeus Company

TravelClick offers innovative, cloud-based and data-driven solutions for hotels around the globe to maximize revenue. TravelClick enables over 25,000 customers to drive better business decisions and know, acquire, convert and retain guests. The Company’s interconnected suite of solutions includes Business Intelligence, Reservations & Booking Engine, Media, Web & Video and Guest Management. As a trusted hotel partner with more than 30 years of industry experience, TravelClick operates in 176 countries, with local experts in 39 countries and 14 offices in New York, Atlanta, Barcelona, Bucharest, Chicago, Dallas, Dubai, Hong Kong, Melbourne, Orlando, Ottawa, Paris, Shanghai and Singapore. The Company also provides its hotel customers with access to a global network of over 600 travel-focused partners. Follow TravelClick on Facebook, Twitter and LinkedIn.

Media Contacts

Grayling Communications

Amadeus.Hospitality@Grayling.com